|

Customs Officials Attacked by

Smugglers

Taxation in Pre-Revolutionary

France

Between 1500 and 1789, France

was the leading power in Europe, dethroning Spain, making

Austria the runner-up, and preceding Britain.

|

|

However . . .

Image Above

Douaniers attaqués

par les contrebandiers

Customs officials

attacked by smugglers.

Le Petit Journal,

end of 19th century, which makes it

post-revolutionary, of course.

Musée National des Douanes |

. . . the country's revenues were based on a very complex system

of taxation.

Carried over from olden times, each province had different tax agreements with the

Crown. The resulting difference in tax rates from province to

province made it necessary to set up internal customs barriers

and was of course both, a challenge and a delight for

smugglers.

As it turned out, this unequal system of taxation

served as major fuel for the 1789

French Revolution. French Revolution.

How so?

What Is the

Direct Connection Between Taxation in Pre-Revolutionary

France and the French Revolution of 1789?

It was the King's deficit that

caused him to desperately call for the

Estates General on

August 8, 1788 — a deficit that could have been taken

care of and balanced out by

tax revenue. Estates General on

August 8, 1788 — a deficit that could have been taken

care of and balanced out by

tax revenue.

But there is more.

Taxes under the ancient

regime were based on privileges. Toward the end of the

ancient regime, two things became apparent:

1

A system based on privileges was felt to be

unjust.

2

A system based on privileges was almost

impossible to reform effectively because it

meant to cut the wings of the privileged,

whose power was given to them by this very

system.

Thus, in a nutshell, taxation in

pre-revolutionary France illustrated the injustice and the

impracticality of the actual cornerstone of French

society at the time — privileges.

And by illustrating its

inability to change, it demonstrated the

need for a major overhaul of the social order in France.

Regarding financial reform see also

Calonne,

Calonne,

Necker, and

Necker, and

Turgot.

Turgot.

Go here for a

complete list of

French finance ministers

under the ancien regime.

French finance ministers

under the ancien regime.

Let's dive in:

Currency

French currency was the livre,

a silver coin worth 20 sols or sous. One

sou was worth 12 deniers.

The louis, or louis d'or,

was a gold coin. It was minted as a half-louis, and as a 2, 4,

8, and 10 louis coin. One louis was worth 24

livres.

Obverse of a 3

livres coin with Louis XVI

sporting a bare neck somewhat invitingly

(Image

obviously enlarged, original is 3.5 cm or 1.37 inch in diameter)

Musée d'art et

d'industrie de Saint-Étienne

Tax Exemption

Nobility and clergy were exempt

from the largest direct tax, the

taille. Most nobles

were also exempt from the

taille. Most nobles

were also exempt from the

vingtième and

enjoyed preferred handling with regards to the

vingtième and

enjoyed preferred handling with regards to the

capitation tax. The

last two taxes were also easy on the clergy by allowing them

to pay a lump sum, the don gratuit, as opposed to

taxing them individually.

capitation tax. The

last two taxes were also easy on the clergy by allowing them

to pay a lump sum, the don gratuit, as opposed to

taxing them individually.

If you had the money, you could

purchase certain offices that came with ennoblement and tax

privileges.

Tax Collection

France imposed direct and

indirect taxes.

Direct taxes were collected by royal tax

officials. At the end of the

ancient regime, almost all

indirect taxes had been outsourced to collection agencies,

either via a 6-year lease to the ferme générale (General

Tax Farm) or to a régie générale.

ancient regime, almost all

indirect taxes had been outsourced to collection agencies,

either via a 6-year lease to the ferme générale (General

Tax Farm) or to a régie générale.

The main difference between the

ferme générale and the régie générale was that

the régie was a syndicate who received a fixed salary and

the risk of revenue fluctuation remained with the Crown. The

ferme

had to pay their annual flat fee no matter how the

economy was doing. On the other hand, the

ferme had lots of leeway and could make a

sweet profit.

Members of the ferme générale

were called fermiers-généraux, or farmers-general.

Members of the régie générale were called

régisseurs.

Farmers General

(Ferme Générale)

The Ferme Générale

(Farmers General or General Tax Farm) was created in 1681 by the famous

Jean-Baptiste Colbert, who lived 1619-1683, and was the

contrôleur Général des Finances under contrôleur Général des Finances under

Louis XIV. Louis XIV.

Colbert sold the right to

collect the royal taxes, i.e. the aide, traite, and

gabelle, for an annual sum

of 56 million livres. Colbert had a say in this

institution and kept

control of it. Later ministers didn't.

In 1747, the tabac was

added to the deal.

The ferme generale became an impressive institution. Five large

fermes generales joined forces

and employed nearly 700 people at their headquarters in

Paris.

After the army, the Farmers General

was the second

largest employer in the country, bringing in more than half of the government's revenue (see pie

chart).

They operated up to 42 branches in the provinces,

which, in turn, kept nearly

25,000 agents across the country busy. These agents were either occupied with

collecting and processing the money or they were fighting smugglers.

::

What were their powers?

To enforce collection, the

farmes generales could seize property. Their

gardes were armed and uniformed. Part of that uniform

was a little shoulder strap

that identified them as acting on behalf of the King. They

enjoyed special privileges and protection of the law. And a

reputation of being very corrupt.

:: How did they make

a profit?

By collecting whatever they owed on their lease, plus profit.

Highest revenue came from

the

gabelle, the salt tax.

Unfortunately, the farmers generals

could arbitrarily collect whatever whenever wherever. This

did not happen all the time but there was little one could

do if it did. On top of that they

made you purchase a certain amount of salt, which of course

had a tax on it.

gabelle, the salt tax.

Unfortunately, the farmers generals

could arbitrarily collect whatever whenever wherever. This

did not happen all the time but there was little one could

do if it did. On top of that they

made you purchase a certain amount of salt, which of course

had a tax on it.

Furthermore, it spoke for itself when these people

arrived suddenly at immense fortunes.

Unpopular for obvious reasons, the Farmers General was

abolished in 1791. The entire institution was nationalized and reduced

to 15,000 agents. Internal customs barriers and the salt tax

were eliminated.

In November 1793, the

Convention

ordered the arrest of all former members of the Ferme

Générale. Many fled. The rest was

Convention

ordered the arrest of all former members of the Ferme

Générale. Many fled. The rest was

guillotined, among them the chemist

Antoine Laurent de Lavoisier.

guillotined, among them the chemist

Antoine Laurent de Lavoisier.

Back to 1780.

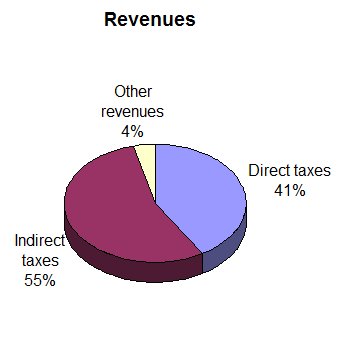

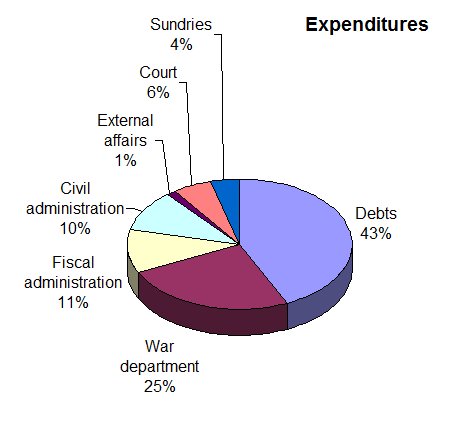

French Budget 1780

Here is French Revenues and

Expenditures around 1780. Population estimated at around 25

million. France had neither

a state bank nor a stock exchange.

France 1780 Total Revenues

— 585 million livres

France 1780 Total

Expenditure — 610 million livres

Deficit: 25

million livres

Based on Cambridge Economic History of Europe, vol. 8, page

370, in turn draws from A. Wagner (1910), pp. 176f.;

and Marion, Histoire, vol. 1 (1914), Appendix, and

Necker's estimates.

Interesting things about these

pies:

Revenues:

-

Odd thing about revenues: nearly

nothing from public lands. In 1773, it was 6.4 million

livres, which was 1.6 % of total revenue. This meant that

the main revenue had to come in via the

other taxes. Meaning, taxation was hard on

the folks that didn't have land. This was contributing to

the resentment that exploded in the Revolution of 1789.

Expenditures:

-

Debt payment

made 43% of the expenditures in 1780. It

climbed up to 50.5% in 1788.

-

Military: 25%, which means a

little bit more than administration (21%). Compared to

Britain and Prussia, France spent much less

on military, but much more on admin.

-

Court: 6% (34 million

livres) was very

high compared with the only other court in Europe that was

able to compete, the court at Vienna.

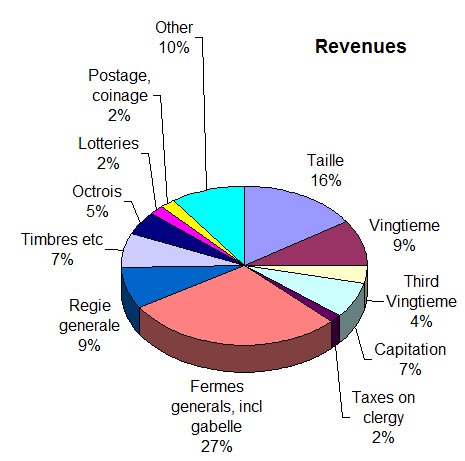

Taxes in Proportion

Here is

Revenues in more detail to illustrate tax proportions:

Taxes in Proportion

France 1780 Total Revenues — 585 million livres

The Taxes in

Short

Different taxes were collected

by different agencies at different times. The situation at

the end of the

ancient régime was as follows:

ancient régime was as follows:

Direct Tax

|

Indirect Tax

|

Collected directly by royal

officials:

Taille

Capitation

Vingtième

|

Collected by the ferme générale:

Gabelle

Tabac

|

| |

Collected by the régie générale:

Aide

Domaine

Traite

|

The Taxes in

Detail

Taille

(Property and Income Tax)

The taille was

an ancient tax,

established in 1445, originally paid to a lord in exchange for his

protection. Hence, clergy and nobility were

exempt.

This was a direct tax on the

property and income of the unprivileged

classes, collected by

royal officials.

Louis XVI

split the taille into taille personnelle

(property / revenue / personal tax) and

taille réelle

(land and house property or household,

applicable in Languedoc,

Provence, Guyenne, Dauphiné).

Louis XVI

split the taille into taille personnelle

(property / revenue / personal tax) and

taille réelle

(land and house property or household,

applicable in Languedoc,

Provence, Guyenne, Dauphiné).

The taille was abolished with

the Revolution.

Capitation (Head Tax)

The capitation was

established in 1695 by

Phélypeaux de

Pontchartrain, originally levied to

pay war expenses. It was a direct tax,

poll tax, on everyone and collected directly by royal officials.

Phélypeaux de

Pontchartrain, originally levied to

pay war expenses. It was a direct tax,

poll tax, on everyone and collected directly by royal officials.

The clergy

paid an annual fee, the don gratuit.

And

that was that.

The nobility, civil servants,

and privileged citizens paid

anything from 20 sous to 2,000 livres, depending on rank,

status, occupation, and property, which put

them in one of the 22 different tax classes.

Vingtième

(Income Tax)

The vingtieme was a direct tax

on everyone,

5 percent on income, collected by

royal officials.

Vingtieme

means one twentieth, which was the standard

rate in 1749.

Clergy, again,

paid the don gratuit (lump sum) and were off the hook.

But also provinces and

cities could do that, meaning in effect that

nobles and officials were usually exempt

from the vingtieme.

The vingtieme was established in May 1749 (Edit

de Marly) by

Machault d'Arnouville. Machault d'Arnouville.

In 1756, a

second vingtieme was created by

Peyrenc de Moras.

Peyrenc de Moras.

In 1760,

Bertin created a third

vingtieme.

Bertin created a third

vingtieme.

In 1786, the

vingtieme was abolished.

Gabelle

(Salt Tax)

The gabelle

was an indirect

tax, a salt tax, on everyone, collected by the ferme générale.

Back in the

days, the gabelle was a tax not only

on salt but on various goods. In 1360, it

became a permanent tax.

It was abolished in March 1790.

France 1781 - Gabelle

Tabac (tobacco)

Tabac was an indirect

tax, formerly a state monopoly, later collected by

the ferme générale.

Aides (Consumption Tax)

Indirect tax,

a consumption or excise tax.

In the Middle

Ages, the aides had to be paid by a

vassal to his lord and were due in four

cases: payment of a ransom if the lord had

been taken prisoner, the knighting of his

eldest son, the marriage of his eldest

daughter, departure on crusade.

The aides

transformed from an exceptional tax to a

regular tax levied on consumer goods, such

as wine, liquor, oil, textiles, tallow, iron,

wood, livestock, playing cards, hides, soap, paper etc.

Thus it became an indirect

tax on everyone. The aides were collected by

the régie générale. Collection was

complex and very tricky due to the regional

inequalities. It even required the creation

of a court, or board of excise

(Cour

des Aides) and a team of

inspectors, brokers, appraisers and so on.

The aides

were abolished with the Revolution.

Domaine

The

domaines were taxes on the royal domain,

the crown lands, collected by

the régie générale.

Keeping an eye

on everything that concerned the lands owned

by the crown was the

Chambre des

Comptes, or

Chamber of Accounts.

Traite (Customs Duty)

Traites

were

collected by the régie générale.

France 1781 - Traites

Timbre (Stamp Tax)

The timbre was

an indirect tax on legal transactions, collected by

the régie générale.

Octroi

(Local Customs)

The octrois were

indirect taxes on goods that were

brought into towns (customs).

Corvée

Not a tax per

se but compulsory labor

service on the peasants.

See also

Corvee.

Corvee.

Tithes

Annual fee paid to

churches

by

landowners.

Smuggling

An absurdly

complex system of taxation naturally provoked

smuggling on an enormous scale. Consequently,

the fight against smugglers cost an enormous

amount of money and required an enormous amount

of manpower.

In 1784,

construction begun in Paris on a continuous

stone wall, known as Mur des Fermiers

Généraux, or

Wall of

the Farmers-General, marking the city

limits at the time. The wall was finished in

1787. It was higher than 3 meters / 10 feet and

23 km / 14 miles long, and its gates were

guarded by tax officials.

This particular

wall was built to limit the evasion of the

octrois.

But the smugglers found their ways around it,

and the wall became a perfect target for the

citizens' wrath. The prices for food were

climbing while the greed of tax collectors were

as widespread as they were well known. A saying

by some unknown author became very popular

during these days:

octrois.

But the smugglers found their ways around it,

and the wall became a perfect target for the

citizens' wrath. The prices for food were

climbing while the greed of tax collectors were

as widespread as they were well known. A saying

by some unknown author became very popular

during these days:

Le

mur murant Paris rend Paris murmurant

It's not snappy at

all after translation, but in other words, The

wall walling Paris renders Paris murmuring.

Or maybe, The wall walling Paris makes Paris

wail.

And talking about

things that snap. On the night of July 12/13,

1789, the citizens of Paris burned 40 tax barriers and

ransacked tax offices.

Today we know, they were just

warming up for the

bastille. bastille.

More About the

French Financial Administration Under the Ancien Regime

Here is Necker's

Compte rendu, 1781,

in French and English:

Compte rendu au roi

Compte rendu au roi

Report to the King

Report to the King

More History

|